It is possible to generate a full tax report with

cryptoTax. This vignette shows how.

Preparing your list of coins

First, you want to fetch the price information for all your coins.

Note: Some exchanges don’t require fetching this information from coinmarketcap because they already give the CAD value of your trades or revenues. However, this is still necessary to get the current value, and therefore your unrealized gains and losses.

library(cryptoTax)

my.coins <- c(

"bitcoin", "ethereum", "cardano", "cronos", "litecoin",

"usd-coin", "binance-usd", "celsius", "presearch",

"ethereum-pow", "basic-attention-token"

)

USD2CAD.table <- cur2CAD_table()

list.prices <- prepare_list_prices(slug = my.coins, start.date = "2021-01-01")Formatting your data

Below we use a shortcut for this vignette to format all exchanges

quickly with lapply() and the format_detect()

function. However, you can use the dedicated functions should you wish

so.

exchanges <- list(

data_adalite, data_binance, data_binance_withdrawals, data_blockfi, data_CDC,

data_CDC_exchange_rewards, data_CDC_exchange_trades, data_CDC_wallet, data_celsius,

data_coinsmart, data_exodus, data_gemini, data_newton, data_pooltool, data_presearch,

data_shakepay, data_uphold

)

formatted.data <- format_detect(exchanges)Adjusted Cost Base

Next, we can begin processing that data. We start by formatting the

Adjusted

Cost Base (ACB) of each transaction. The formatted.ACB

is going to be our core object with which we will be working for all

future steps.

formatted.ACB <- format_ACB(formatted.data)

#> Process started at 2024-12-28 18:11:30.911772. Please be patient as the transactions process.

#> [Formatting ACB (progress bar repeats for each coin)...]

#> Note: Adjusted cost base (ACB) and capital gains have been adjusted for the superficial loss rule. To avoid this, use argument `sup.loss = FALSE`.

#> Process ended at 2024-12-28 18:11:33.13937. Total time elapsed: 0.04 minutesPer default,

format_ACB()considers taxable revenue (and not aquisition at $0 ACB) the following transaction types: staking, interests, and mining. If you want a different treatment for those transactions (or other types of revenues like cashback and airdrops), use theas.revenueargument offormat_ACB().

We get a warning that there are negative values in some places,

therefore that we might have forgotten some transactions. The

check_missing_transactions() function makes it easy to

identify which transactions (and therefore which coin) are concerned

with this.

check_missing_transactions(formatted.ACB)

#> # A tibble: 3 × 26

#> # Groups: currency [11]

#> date currency quantity total.price spot.rate transaction fees

#> <dttm> <chr> <dbl> <dbl> <dbl> <chr> <dbl>

#> 1 2021-03-07 21:46:57 BAT 52.6 57.1 1.09 sell 0

#> 2 2021-04-05 12:22:00 BAT 8.52 0 1.55 revenue 0

#> 3 2021-04-06 04:47:00 BAT 8.52 10.4 1.22 sell 0

#> # ℹ 19 more variables: description <chr>, comment <chr>, revenue.type <chr>,

#> # value <dbl>, exchange <chr>, rate.source <chr>, currency2 <chr>,

#> # total.quantity <dbl>, suploss.range <Interval>, quantity.60days <dbl>,

#> # share.left60 <dbl>, sup.loss.quantity <dbl>, sup.loss <lgl>,

#> # gains.uncorrected <dbl>, gains.sup <dbl>, gains.excess <lgl>, gains <dbl>,

#> # ACB <dbl>, ACB.share <dbl>Next, we might want to make sure that we have downloaded the latest

files for each exchange. If you shake your phone every day for sats, or

you receive daily weekly payments from staking, you would expect the

latest date to be recent. For this we use the

get_latest_transactions() function.

get_latest_transactions(formatted.ACB)

#> # A tibble: 14 × 2

#> # Groups: exchange [14]

#> exchange date

#> <chr> <dttm>

#> 1 CDC 2021-07-28 23:23:04

#> 2 CDC.exchange 2021-12-24 15:34:45

#> 3 CDC.wallet 2021-06-26 14:51:02

#> 4 adalite 2021-05-17 21:31:00

#> 5 binance 2022-11-27 08:05:35

#> 6 blockfi 2021-10-24 04:29:23

#> 7 celsius 2021-05-23 05:00:00

#> 8 coinsmart 2021-06-03 02:04:49

#> 9 exodus 2021-06-12 22:31:35

#> 10 gemini 2021-06-18 01:38:54

#> 11 newton 2021-06-16 18:49:11

#> 12 presearch 2021-05-07 05:55:33

#> 13 shakepay 2021-07-10 00:52:19

#> 14 uphold 2021-06-09 04:52:23At this stage, it is possible to list transactions by coin, if you

have few transactions. The output can be very long as soon as you have

many transactions however, so we will not be showing it here, but you

can have a look at the listby_coin() function and its

example.

Full Tax Report

Next, we need to calculate a few extra bits of information for the

final report. Fortunately, the prepare_report() function

makes this easy for us.

report.info <- prepare_report(formatted.ACB,

tax.year = 2021,

local.timezone = "America/Toronto",

list.prices = list.prices

)The report.info object is a list containing all the

different info (tables, figures) necessary for the final report. They

can be accessed individually too:

names(report.info)

#> [1] "report.overview" "report.summary" "proceeds" "sup.losses"

#> [5] "table.revenues" "tax.box" "pie_exchange" "pie_revenue"

#> [9] "local.timezone"Finally, to generate the report, we use print_report()

with the relevant information:

print_report(formatted.ACB,

list.prices = list.prices,

tax.year = "2021",

name = "Mr. Cryptoltruist",

local.timezone = "America/Toronto"

)Full Crypto Tax Report for Tax Year 2021

Name: Mr. Cryptoltruist

Date: Sat Dec 28 18:11:33 2024

Summary

Type |

Amount |

currency |

|---|---|---|

gains |

12,656.89 |

CAD |

losses |

0.00 |

CAD |

net |

12,656.89 |

CAD |

total.cost |

16,625.70 |

CAD |

value.today |

NA |

CAD |

unrealized.gains |

0.00 |

CAD |

unrealized.losses |

0.00 |

CAD |

unrealized.net |

0.00 |

CAD |

percentage.up |

NA% |

CAD |

all.time.up |

NA% |

CAD |

#> Warning in format_dollars(report.info$report.summary$Amount[6], "numeric"): NAs

#> introduced by coercionAll time up in percentage (including all unrealized gains and revenues received) is NA%. In absolute dollars, that is 13152.82 CAD.

Overview

date.last |

currency |

total.quantity |

cost.share |

total.cost |

gains |

losses |

net |

currency2 |

|---|---|---|---|---|---|---|---|---|

2021-12-24 15:34:45 |

CRO |

19,234.2928403 |

0.76 |

14,695.66 |

0.00 |

0.00 |

0.00 |

CRO |

2021-10-24 04:29:23 |

LTC |

5.5542096 |

207.02 |

1,149.83 |

1,906.29 |

0.00 |

1,906.29 |

LTC |

2021-06-06 22:14:11 |

ADA |

209.0297373 |

1.23 |

257.10 |

0.90 |

0.00 |

0.90 |

ADA |

2021-08-07 21:43:44 |

BTC |

0.0054492 |

28,427.97 |

154.91 |

143.37 |

0.00 |

143.37 |

BTC |

2021-12-24 15:34:45 |

ETH |

0.0761972 |

1,717.68 |

130.88 |

10,538.80 |

0.00 |

10,538.80 |

ETH |

2021-06-18 01:38:54 |

BAT |

29.6939758 |

2.91 |

86.38 |

67.52 |

0.00 |

67.52 |

BAT |

2021-05-07 05:55:33 |

PRE |

1,001.3000000 |

0.08 |

78.97 |

0.00 |

0.00 |

0.00 |

PRE |

2022-11-27 08:05:35 |

USDC |

49.2669990 |

1.24 |

60.92 |

0.00 |

0.00 |

0.00 |

USDC |

2022-11-27 08:05:35 |

BUSD |

5.8763653 |

1.34 |

7.85 |

0.00 |

0.00 |

0.00 |

BUSD |

2022-11-17 11:54:25 |

ETHW |

0.3559272 |

8.99 |

3.20 |

0.00 |

0.00 |

0.00 |

ETHW |

2022-11-27 08:05:35 |

Total |

16,625.70 |

12,656.88 |

0.00 |

12,656.88 |

Total |

Current Value

currency |

cost.share |

total.cost |

rate.today |

value.today |

unrealized.gains |

unrealized.losses |

unrealized.net |

currency2 |

|---|---|---|---|---|---|---|---|---|

CRO |

0.76 |

14,695.66 |

CRO |

|||||

LTC |

207.02 |

1,149.83 |

LTC |

|||||

ADA |

1.23 |

257.10 |

ADA |

|||||

BTC |

28,427.97 |

154.91 |

BTC |

|||||

ETH |

1,717.68 |

130.88 |

ETH |

|||||

BAT |

2.91 |

86.38 |

BAT |

|||||

PRE |

0.08 |

78.97 |

PRE |

|||||

USDC |

1.24 |

60.92 |

USDC |

|||||

BUSD |

1.34 |

7.85 |

BUSD |

|||||

ETHW |

8.99 |

3.20 |

ETHW |

|||||

Total |

16,625.70 |

0.00 |

0.00 |

0 |

0.00 |

Total |

||

currency |

cost.share |

total.cost |

rate.today |

value.today |

unrealized.gains |

unrealized.losses |

unrealized.net |

currency2 |

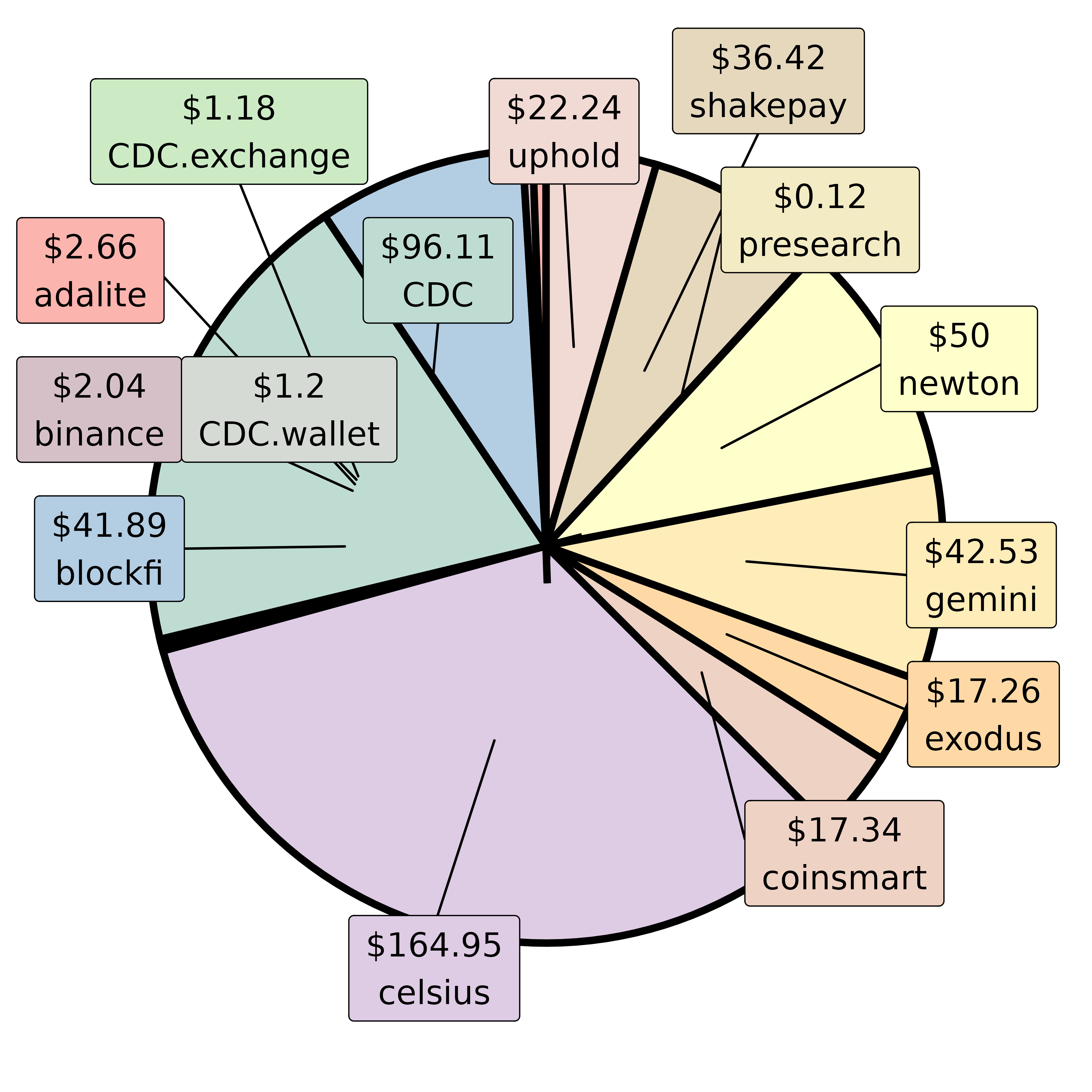

Revenues

exchange |

date.last |

total.revenues |

airdrops |

referrals |

staking |

promos |

interests |

rebates |

rewards |

forks |

mining |

currency |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

CDC |

2021-07-23 17:21:19 |

96.11 |

0.00 |

30.15 |

0.00 |

0.00 |

10.36 |

51.15 |

1.20 |

3.20 |

0.00 |

CAD |

CDC.exchange |

2021-09-07 00:00:00 |

1.18 |

0.00 |

0.00 |

0.00 |

0.00 |

1.16 |

0.01 |

0.00 |

0.00 |

0.00 |

CAD |

CDC.wallet |

2021-06-26 14:51:02 |

1.20 |

0.00 |

0.00 |

1.20 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

CAD |

adalite |

2021-05-17 17:16:00 |

2.66 |

0.00 |

0.00 |

2.66 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

CAD |

binance |

2021-11-05 04:32:23 |

2.04 |

0.00 |

0.00 |

0.00 |

0.00 |

0.13 |

1.91 |

0.00 |

0.00 |

0.00 |

CAD |

blockfi |

2021-08-07 21:43:44 |

41.89 |

0.00 |

8.35 |

0.00 |

24.20 |

9.35 |

0.00 |

0.00 |

0.00 |

0.00 |

CAD |

celsius |

2021-05-23 05:00:00 |

164.95 |

0.00 |

50.32 |

0.00 |

111.52 |

3.11 |

0.00 |

0.00 |

0.00 |

0.00 |

CAD |

coinsmart |

2021-05-15 16:42:07 |

17.34 |

2.34 |

15.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

CAD |

exodus |

2021-06-06 22:14:11 |

17.26 |

0.00 |

0.00 |

17.26 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

CAD |

gemini |

2021-06-18 01:38:54 |

42.53 |

16.56 |

25.97 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

CAD |

newton |

2021-06-16 18:49:11 |

50.00 |

0.00 |

50.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

CAD |

presearch |

2021-04-27 19:12:15 |

0.12 |

0.12 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

CAD |

shakepay |

2021-06-23 12:21:49 |

36.42 |

36.42 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

CAD |

uphold |

2021-06-09 04:52:23 |

22.24 |

22.24 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

CAD |

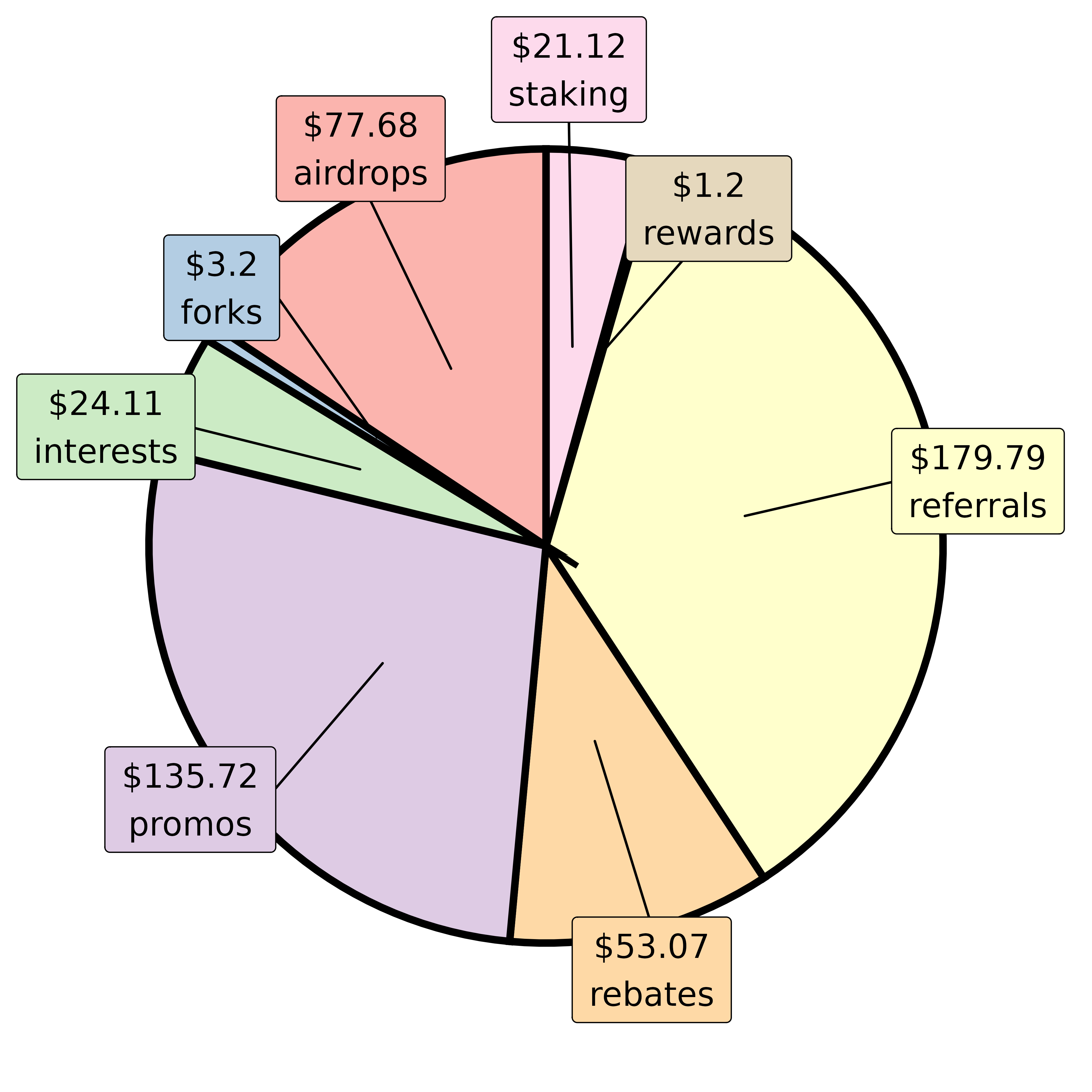

total |

2021-11-05 04:32:23 |

495.94 |

77.68 |

179.79 |

21.12 |

135.72 |

24.11 |

53.08 |

1.20 |

3.20 |

0.00 |

CAD |

exchange |

date.last |

total.revenues |

airdrops |

referrals |

staking |

promos |

interests |

rebates |

rewards |

forks |

mining |

currency |

Important Tax Information for Your Accountant

Capital gains

Your capital gains for 2021 are $12,656.89, whereas your capital losses are $0.00 (net = $12,656.89).

Those are only taxed at 50%. Your capital losses are calculated as total capital losses ($0.02) - superficial losses ($0.02) = actual capital losses ($0).

Your total “proceeds” for the coins you sold at a profit is: $19,381.32 (aggregated for all coins). Your total ACB for the coins you sold at a profit is: $6,724.43 (average of all coins). The difference between the two is your capital gains: $12,656.89.

Your total “proceeds” (adjusted for superficial gains) for the coins you sold at a loss is: $0.00 (aggregated for all coins). Your total ACB for the coins you sold at a loss is: $0.00 (average of all coins). The difference between the two is your capital losses: $0.00.

Income

Your total taxable income from crypto (from interest & staking exclusively) for 2021 is $45.23, which is considered 100% taxable income.

Note that per default, this amount excludes revenue from credit card cashback because it is considered rebate, not income, so considered acquired at the fair market value at the time of reception. The income reported above also excludes other forms of airdrops and rewards (e.g., from Shakepay, Brave, Presearch), referrals, and promos, which are considered acquired at a cost of 0$ (and will thus incur a capital gain of 100% upon selling). Note that should you wish to give different tax treatment to the different transaction types, you can do so through the ‘as.revenue’ argument of the ‘ACB’ function. Mining rewards needs to be labelled individually in the files before using

format_ACB().

Total tax estimation

In general, you can expect to pay tax on 50% ($6,328.44) of your net capital gains + 100% of your taxable income ($45.23), for a total of $6,373.67. This amount will be taxed based on your tax bracket.

Note that if your capital gains are net negative for the current year, any excess capital losses can be deferred to following years. However, capital losses have to be used in the same year first if you have outstanding capital gains.

Form T1135

If your total acquisition cost has been greater than $100,000 at any point during 2021 (it is $16,625.70 at the time of this report), you will need to fill form T1135 (Foreign Income Verification Statement). Form T1135 is available for download, and more information about it can be found on the CRA website.

Summary table

Here is a summary of what you need to enter on which lines of your income tax:

Description |

Amount |

Comment |

Line |

|---|---|---|---|

Gains proceeds |

19,381.32 |

Proceeds of sold coins (gains) |

Schedule 3, line 15199 column 2 |

Gains ACB |

6,724.43 |

ACB of sold coins (gains) |

Schedule 3, line 15199 column 3 |

Gains |

12,656.89 |

Proceeds - ACB (gains) |

Schedule 3, lines 15199 column 5 & 15300 |

50% of gains |

6,328.44 |

Half of gains |

T1, line 12700; Schedule 3, line 15300, 19900 |

Outlays of gains |

0.00 |

Expenses and trading fees (gains). Normally already integrated in the ACB |

Tax software |

Losses proceeds |

0.00 |

Proceeds of sold coins (losses) |

Schedule 3, line 15199 column 2 |

Losses ACB |

0.00 |

ACB of sold coins (losses) |

Schedule 3, line 15199 column 3 |

Losses |

0.00 |

Proceeds - ACB (losses) |

Schedule 3, lines 15199 column 5 & 15300 |

50% of losses |

0.00 |

Half of losses |

T1, line 12700; Schedule 3, line 15300, 19900 |

Outlays of losses |

0.00 |

Expenses and trading fees (losses). Normally already integrated in the ACB |

Tax software |

Foreign income |

45.23 |

Income from crypto interest or staking is considered foreign income |

T1, line 13000, T1135 |

Foreign gains (losses) |

12,656.89 |

Capital gains from crypto is considered foreign capital gains |

T1135 |

Other situations

If applicable, you may also need to enter the following:

Interest expense on money borrowed to purchase investments for the purpose of gaining or producing income is tax-deductible. Use line 22100 (was line 221) of the personal income tax return, after completion of Schedule 4 (federal).

……………………………………………………………………………………………………………………………………………………………………………….